Harley Davidson Financial Analysis

INTRODUCTION This project is one of three reports I will complete as part of the strategic analysis of Harley-Davidson.

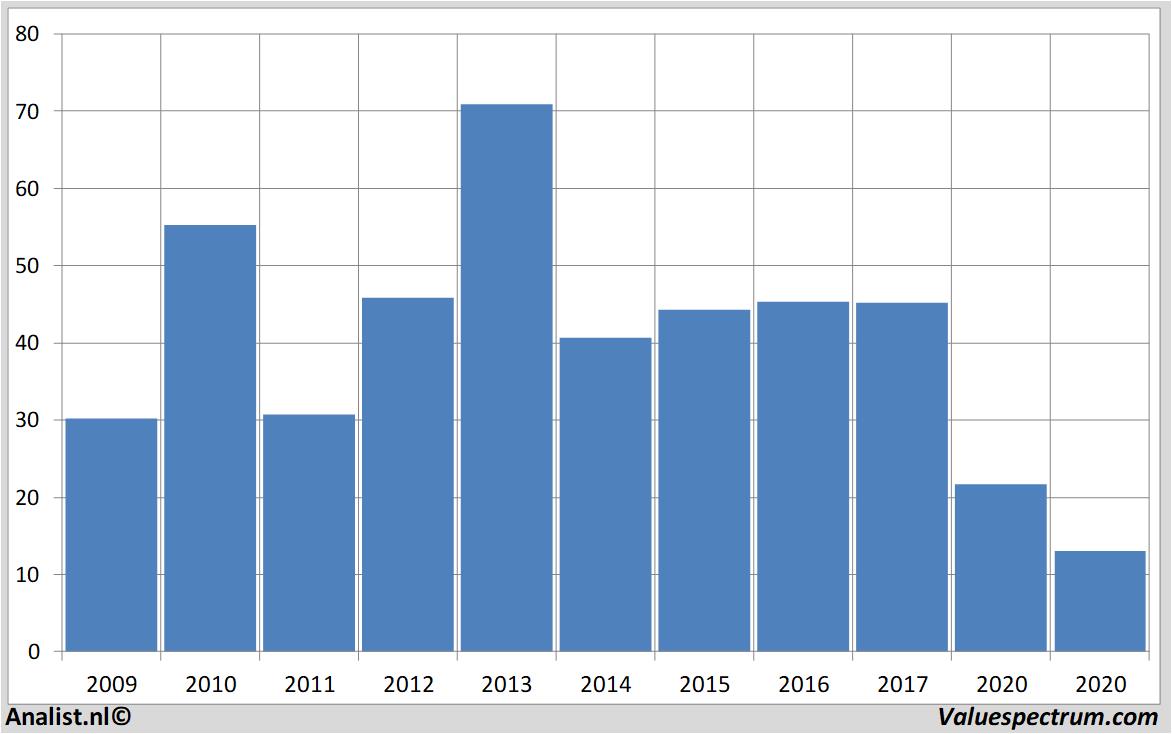

Harley davidson financial analysis. The net profit of the company was USD 59911 million during the fiscal year 2011 an increase of 30883 over 2010. Engages in the production and sale of heavyweight motorcycles. We have conducted a comparative analysis of the balance sheet and the income statement of Harley-Davidson Inc.

This project is for the FA -18 Financial Management Course at Wisconsin Luther College. ANALYSIS Harley Davidson Zach Jones 1. Harley consists oftwo segments.

Harley-Davidson designs manufactures and sells heavyweight motorcycles. This first report focuses on strategy analysis and includes the following sections. The primary business activity of the company is Motorcycles Bicycles and Parts SIC code 3751.

The Motorcycles and Related Products segment designs manufactures and sells cruiser and touring motorcycles for the heavyweight market. Mahmoud Abdel Hamid Karim Mohsen Mohamed Hossam Mohamed Madkour4092011 2 3. EBTEBIT The companys operating income margin or return on sales ROS is EBIT.

Developed a Word document entitled The Analysis of H-Ds Current Strategy. Discounted Cash Flow Model. - Financial and Strategic Analysis Review Publication Date.

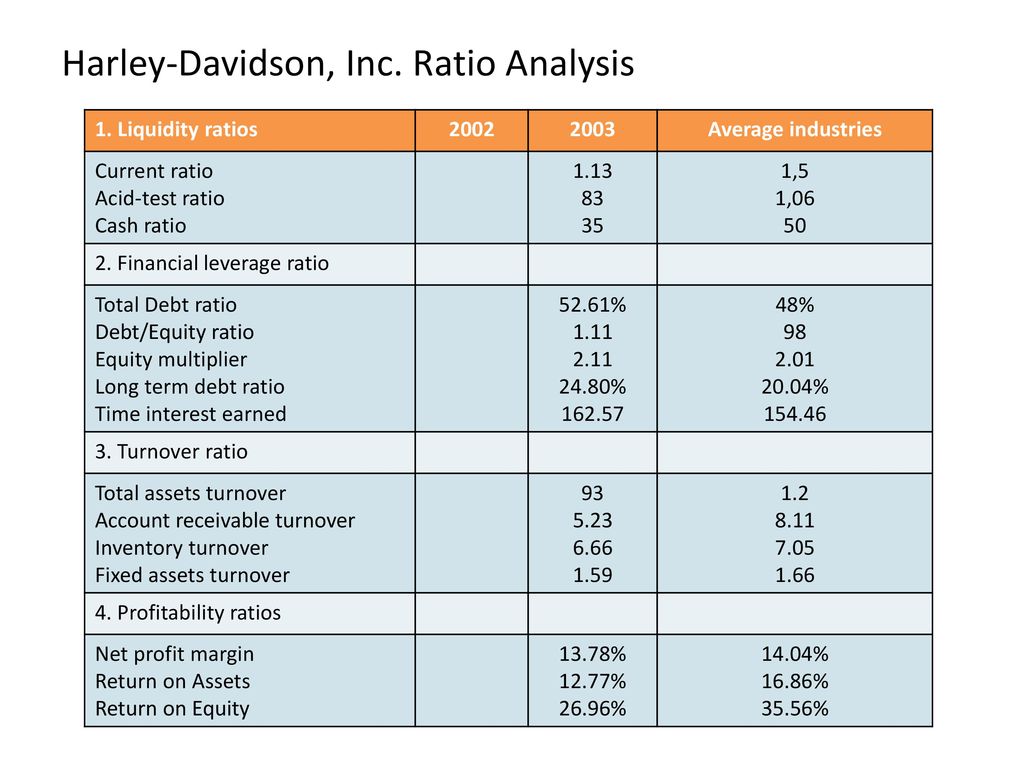

A Strategic Audit Analysis. The Investor Relations website contains information about Harley-Davidson USAs business for stockholders potential investors and financial analysts. Income statements balance sheets cash flow statements and key ratios.